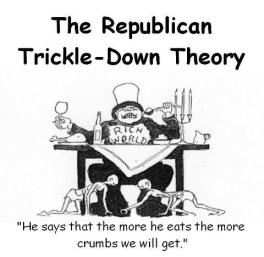

Is the Wealth of the Rich Merely Trickling Down to Us?

20 August, 2012 2 Comments

The “trickle-down” theory is a ludicrous attempt to justify economic inequality on the grounds that the poor can live of the crumbs that are falling from the rich man’s table – and the richer the man, the more crumbs will fall to the poor. It is also known as the “horse and sparrows” theory: if a horse is fed oat, some oat will fall by the wayside to be eaten by sparrows, and the more oat you feed the horse, the more oat also to the poor sparrows. Of course, this theory is an easy target for ridicule from advocates of economic equality – an easy straw man to attack. The poor would gain much more if the rich were heavily taxed or if their wealth were outright confiscated and distributed equally among us poor. That is their reasoning, anyway. “Trickle-down” should be replaced by “loot-and-plunder”.

I found this cartoon on Facebook to illustrate the theory:

There is, however, not a shred of truth in this theory. Consider what the productive rich are actually doing with their money. They save it, invest it, make profits that they then re-invest, make more profits, re-invest them, and this just goes on and on. (I wrote “the productive rich”; there are also worthless heirs that squander their money, but then they will lose their wealth.[1] The guy in the picture above will certainly soon become poor, if he does nothing but wining and dining. And then there are the politicians, who take our money and squander it on their own pet projects; and they, too, are wining and dining a lot.)

Of course, taxing the poor makes the poor poorer; but, paradoxical as it may sound, taxing the rich also makes the poor poorer, although in a more indirect way.

As is so often the case, George Reisman explains it best, so let me quote him:

The progressive personal income tax, the corporate income tax, and the capital gains tax all operate in essentially the same way as the inheritance tax. They are all paid with funds that otherwise would have been saved and invested. All of them reduce the demand for labor by business firms in comparison with what it would otherwise have been, and thus either the wage rates or the volume of employment that business firms can offer. For they deprive business firms of the funds with which to pay wages.

By the same token, they deprive business firms of the funds with which to buy capital goods. This, together with the greater spending for consumers’ goods emanating from the government, as it spends the tax proceeds, causes the production of capital goods to drop relative to the production of consumers’ goods. In addition, of course, they all operate to reduce the degree of capital intensiveness in the economic system and thus its ability to implement technological advances. […] [T]hese taxes, along with the inheritance tax, undermine capital accumulation and the rise in the productivity of labor and real wages, and thus the standard of living for everyone, not just of those on whom the taxes are levied. (Capitalism: A Treatise on Economics, p. 308.)

In my own words: taxing the rich will lead to fewer jobs, lower real wages, less labor saving machinery; in short, a lower standard of living for us who are poor (or relatively poor).

Some taxes hurt the poor directly, for example taxes on tobacco, or alcoholic liquors, or petrol. It stands to reason that a poor person may have to give up smoking or drinking simply because the alternative would be to give up eating or moving out of his apartment and become homeless; while a rich person may continue his consumption of Habana cigars and vintage wine without even noticing the extra expense. And a poor person may not be able to afford driving his car to work, while Al Gore and his ilk will continue to ride in limousines or tour the world in air planes to teach the rest of us to take the bicycle instead of the car to avoid carbon emissions and “save the climate”. This is, to put it diplomatically, a vile injustice.

That the common income tax and VAT hurt us economically goes without saying: and this any educated laymen can understand. But taxes on the rich are especially insidious, because they do not at a cursory glance seem to harm the poor. But, as explained above, they do.

But back to the idea that this is “trickle-down”. George Reisman again:

Of course, many people will characterize the line of argument I have just given as the “trickle-down” theory. There is nothing trickle-down about it. There is only the fact that capital accumulation and economic progress depend on saving and innovation and that these in turn depend on the freedom to make high profits and accumulate great wealth. The only alternative to improvement for all, through economic progress, achieved in this way, is the futile attempt of some men to gain at the expense of others by means of looting and plundering. This, the loot-and-plunder theory, is the alternative advocated by the critics of the misnamed trickle-down theory. (Ibid., p. 310.)

The productive rich (think Rockefeller, Carnegie, Ford, Bill Gates, Steve Jobs, etcetera, etcetera) actually flood the rest of us with wealth (and themselves become wealthy in the process). Taxing or expropriating them simply means to dam this flood. And this may make it appear “trickle-down” – because governments and politicians will only allow a small portion of this wealth to trickle down to us; the rest of it lands in their own pockets.

[1]) It has actually been argued that such squanderers are a boon to the economy: there is a famous book called The Fable of the Bees by Bernard de Mandeville, published 1714 that argues this. The argument is that the worthless heir who splashes his money around makes the restaurants (or brothels) he frequents richer; while his frugal brother, who spends and invests his fortunes, has no such visible effects. As one can expect, Mandeville’s book has been praised by John Maynard Keynes. In fact, this is of course a variant of the “broken windows” fallacy; if one does not focus on the immediate effects but also on the long range effects, one will see that the frugal brother is of benefit to the economy, not the worthless heir.

Pingback: TRICKLE DOWN WAS A GOP TRICK! | Concise Politics

Pingback: Vi behöver våra miljardärer! | Hemma hos POS