Is Christianity the Source of Western Values?

22 November, 2016

Recently on Facebook somebody linked to George Reisman’s essay Education and the Racist Road to Barbarism[1] and gave a couple of lengthy quotes:

In order to understand the implications, it is first necessary to remind oneself what Western civilization is. From a historical perspective, Western civilization embraces two main periods: the era of Greco-Roman civilization and the era of modern Western civilization, which latter encompasses the rediscovery of Greco-Roman civilization in the late Middle Ages, and the periods of the Renaissance, the Enlightenment, and the Industrial Revolution. Modern Western civilization continues down to the present moment, of course, as the dominant force in the culture of the countries of Western Europe and the United States and the other countries settled by the descendants of West Europeans. It is an increasingly powerful force in the rapidly progressing countries of the Far East, such as Japan, Taiwan, and South Korea, whose economies rest on “Western” foundations in every essential respect.

From the perspective of intellectual and cultural content, Western civilization represents an understanding and acceptance of the following: the laws of logic; the concept of causality and, consequently, of a universe ruled by natural laws intelligible to man; on these foundations, the whole known corpus of the laws of mathematics and science; the individual’s self-responsibility based on his free will to choose between good and evil; the value of man above all other species on the basis of his unique possession of the power of reason; the value and competence of the individual human being and his corollary possession of individual rights, among them the right to life, liberty, property, and the pursuit of happiness; the need for limited government and for the individual’s freedom from the state; on this entire preceding foundation, the validity of capitalism, with its unprecedented and continuing economic development in terms of division of labor, technological progress, capital accumulation, and rising living standards; in addition, the importance of visual arts and literature depicting man as capable of facing the world with confidence in his power to succeed, and music featuring harmony and melody.

And:

For the case of a Westernized individual, I must think of myself. I am not of West European descent. All four of my grandparents came to the United States from Russia, about a century ago. Modern Western civilization did not originate in Russia and hardly touched it. The only connection my more remote ancestors had with the civilization of Greece and Rome was probably to help in looting and plundering it. Nevertheless, I am thoroughly a Westerner. I am a Westerner because of the ideas and values I hold. I have thoroughly internalized all of the leading features of Western civilization. They are now my ideas and my values. Holding these ideas and values as I do, I would be a Westerner wherever I lived and whenever I was born. I identify with Greece and Rome, and not with my ancestors of that time, because I share the ideas and values of Greece and Rome, not those of my ancestors. To put it bluntly, my ancestors were savages–certainly up to about a thousand years ago, and, for all practical purposes, probably as recently as four or five generations ago. . . .

There is no need for me to dwell any further on my own savage ancestors. The plain truth is that everyone’s ancestors were savages–indeed, at least 99.5 percent of everyone’s ancestors were savages, even in the case of descendants of the founders of the world’s oldest civilizations. For mankind has existed on earth for a million years, yet the very oldest of civilizations–as judged by the criterion of having possessed a written language–did not appear until less than 5,000 years ago. The ancestors of those who today live in Britain or France or most of Spain were savages as recently as the time of Julius Caesar, slightly more than 2,000 years ago. Thus, on the scale of mankind’s total presence on earth, today’s Englishmen, Frenchmen, and Spaniards earn an ancestral savagery rating of 99.8 percent. The ancestors of today’s Germans and Scandinavians were savages even more recently and thus today’s Germans and Scandinavians probably deserve an ancestral savagery rating of at least 99.9 percent.

It is important to stress these facts to be aware how little significance is to be attached to the members of any race or linguistic group achieving civilization sooner rather than later. Between the descendants of the world’s oldest civilizations and those who might first aspire to civilization at the present moment, there is a difference of at most one-half of one percent on the time scale of man’s existence on earth.

These observations should confirm the fact that there is no reason for believing that civilization is in any way a property of any particular race or ethnic group. It is strictly an intellectual matter–ultimately, a matter of the presence or absence of certain fundamental ideas underlying the acquisition of further knowledge.

One commenter wrote:

Reisman oddly omits the influence of biblical religion on the development of Western civilization, until recently known as Christendom, which in fact is the source of most of the values he claims to cherish.

What values?

- Suffering and sacrifice? Jesus is supposed to have suffered and died for our sins (not his own), and Christians are admonished to emulate Jesus, as best they can.

And this is not the first instance of extolling sacrifice in the Judeo-Christian religions. Remember the story in Genesis of how God commanded Abraham to sacrifice his only son, which Abraham was quite prepared to do. God did this to test Abraham’s faith in him, and when it was tested, Isaac was replaced by a goat.[2]

And this is not the first instance of extolling sacrifice in the Judeo-Christian religions. Remember the story in Genesis of how God commanded Abraham to sacrifice his only son, which Abraham was quite prepared to do. God did this to test Abraham’s faith in him, and when it was tested, Isaac was replaced by a goat.[2]

Or take the Book of Job, where the Lord kills all of Job’s family in order to test Job’s faith in him. After a long and tedious discussion between the Lord and Job, Job finally concedes this act was totally just, and the Lord then gives him a brand new family. A consolation for Job, but not much of a consolation for the family killed. In this book in the Bible, God acts exactly like a mafia boss.

Back from pre-historic times to the present. The latest canonized saint, Mother Teresa, saw suffering as a great value – so great that she did not bother to offer dying patients any kind of palliative care, but let them suffer great pain, arguing that the pain meant that “Jesus was kissing them”[3]. To any decent person, this is an example of pure and unadulterated sadism; but by the Catholic Church – and by many others as well – Mother Teresa is hailed as a paragon of goodness.

- Original sin? – i.e. the notion that man is depraved by nature, that he is born in sin[4], and that the only thing he can do to remove his own sinfulness is to embrace the idea that Jesus has taken all his sins on himself and suffered and died for them.

What does it mean to say that man is born in sin and cannot escape his own sinfulness? Well, to be born is a sin; one of the first things a newborn child does is learn how to crawl, and then walk, and then run and jump. This must be sinful. And then a child learns to talk – at first in single words, then in two-word sentences, and eventually he masters his first language and moves on to learn one or more foreign languages. But all of this has to be sinful. A few children very early learn to play musical instruments, and some, like Mozart, start composing symphonies at a very early age. No matter how well such a child plays, and no matter how beautiful the symphonies, this is sinful, thus evil. But this is an idea that nobody could seriously maintain. Walking, talking, composing symphonies are all good things![5]

All this changes, when you accept Jesus as your savior. But it remains unclear in what way it changes. It should be noticed, in this connection, that Jesus died for our sins some 2 000 years ago. It is hard to give an exact measurement – but has there been less sinfulness and less evil in the world since that time?

And who stands to gain and who stands to lose, if we accept original sin? The sinner – the actual evil-doer – stands to gain, for whatever sin he commits, he can always claim that he is no worse than anyone else – and also, he just couldn’t help it, since he was born in sin.

The prophet Isaiah tells us:

If your sins prove to be like crimson, they will become white as snow; if they prove to be as red as crimson dye, they shall become as wool. (Isaiah, 1:18.)

But what happens, if our actions are already white as snow?

And of course John Galt – an upholder of Western values – refused to be born with original sin.

- The sin of pride? Or the corollary virtue of humility?

If we are born in sin and can only do sinful things, then of course it is an even greater sin to take pride in what we do, and Christianity thus teaches us to “eat humble pie”. But it may be illuminating to compare this to one of the Founding Fathers – perhaps the Founding father – of Western values: Aristotle. In The Nicomachean Ethics, he says that pride is “the crown of the virtues”. It is worth quoting him:

Now the proud man, since he deserves most, must be good in the highest degree; for the better man always deserves more, and the best man most. Therefore the truly proud man must be good. And greatness in every virtue would seem to be characteristic of a proud man. […] If we consider him point by point we shall see the utter absurdity of a proud man who is not good. Nor, again, would he be worthy of honour if he were bad; for honour is the prize of virtue, and it to the good that it is rendered. Pride, then, seems to be a sort of crown of the virtues; for it makes them greater, and it is not found without them. Therefore it is hard to be truly proud; for it is impossible without nobility and goodness of character. (The Nicomachean Ethics, book 4, chapter 3; translated by David Ross.)

And Ayn Rand, in Galt’s speech, calls pride (which she identifies as “moral ambitiousness”) “the sum of all values”.

When Christianity denigrates pride and elevates humility as a virtue, it merely tells us to blindly accept its doctrine of man’s depravity and of original sin.

- Justice? God’s behavior toward Job is hardly just. And in the Gospels we read:

But I tell you, love your enemies and pray for those who persecute you, that you may be children of your Father in heaven. He causes his sun to rise on the evil and the good, and sends rain on the righteous and the unrighteous. (Matthew 5:44–45.)

It is a metaphysical fact that the sun and the rain does not make a distinction between good people and evil people. But the Gospel attributes this to God and tells us to be like God and make no such distinction. And this shows that the Christian God is neither moral nor immoral: he is amoral.

- Loving one’s family? Loving one’s life? Well, this what Jesus says:

If anyone comes to me and does not hate father and mother, wife and children, brothers and sisters—yes, even their own life—such a person cannot be my disciple. (Luke 14:26.)

- And what about science – one of the basic Western values Reisman mentions? I just have to refer you to the fate of Galileo. Or, for that matter, to the story of the Garden of Eden: Adam and Eve were driven out, because they had the temerity to eat from the tree of knowledge. God was opposed to knowledge!

- What about causality? What about “a universe ruled by natural laws intelligible to man”? The Bible is full of miracles, and a miracle by definition is an exception to the law of causality.

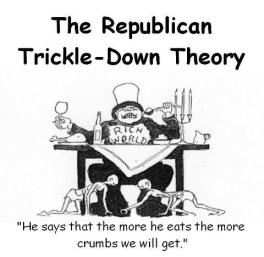

- And what about economics? What is the relation between Christianity and capitalism?

Do not store up for yourselves treasures on earth, where moths and vermin destroy, and where thieves break in and steal. But store up for yourselves treasures in heaven, where moths and vermin do not destroy, and where thieves do not break in and steal. […] You cannot serve both God and money. (Matthew 6:19–20, 24.)

And what is the Christian view on time preference? Another quote from the same chapter:

Therefore I tell you, do not worry about your life, what you will eat or drink; or about your body, what you will wear. Is not life more than food, and the body more than clothes? Look at the birds of the air; they do not sow or reap or store away in barns, and yet your heavenly Father feeds them. Are you not much more valuable than they? Can any one of you by worrying add a single hour to your life?

And why do you worry about clothes? See how the flowers of the field grow. They do not labor or spin. Yet I tell you that not even Solomon in all his splendor was dressed like one of these. If that is how God clothes the grass of the field, which is here today and tomorrow is thrown into the fire, will he not much more clothe you—you of little faith? (Matthew 6:25–30.)

Saving and capital accumulation is definitely not recommended by the Gospel!

Some people will now object that the “Protestant work ethic” is the basis of capitalism.[6] But what is the reasoning here? Jean Calvin taught that every man is predestined both for success or failure in this life and for eternal salvation or condemnation. So the followers of Calvin worked hard just to show to themselves and to others that they are predestined for success and salvation rather than failure and condemnation. All I can say about this reasoning is that it is odd.

- And what is the Christian view of free will? On the idea that we can actually choose between good and evil?

Most Christians, I believe, at least implicitly uphold free will, since it would be senseless to reward the good and punish the evil by eternal salvation and eternal condemnation, if man just can’t help what he does. But Jean Calvin could hardly have believed in free will, if he says that our eternal fate is predestined. And Martin Luther quite adamantly opposed the idea in a tract called On the Bondage of the Will.[7] He argues that free will is against what the Bible teaches, and he says that if man had free will, it could only mean the will to do evil:

In Romans 1:18, Paul teaches that all men without exception deserve to be punished by God: “The wrath of God is revealed from heaven against all ungodliness and unrighteousness of men, who hold the truth in unrighteousness.” If all men have “free will” and yet all without exception are under God’s wrath, then it follows that “free will” leads them in only one direction—“ungodliness and unrighteousness” (i.e., wickedness). So where is the power of “free will” helping them to do good? If “free will” exists, it does not seem to be able to help men to salvation because it still leaves them under the wrath of God.

And:

This universal slavery to sin includes those who appear to be the best and most upright. No matter how much goodness men may naturally achieve, this is not the same thing as the knowledge of God. The most excellent thing about men is their reason and their will, but it has to be acknowledged that this noblest part is corrupt.

And:

Now, “free will” certainly has no heavenly origin. It is of the earth, and there is no other possibility. This can only mean, therefore, that “free will” has nothing to do with heavenly things. It can only be concerned with earthly things.

Well, since Objectivism rejects the supernatural, free will in Objectivism “can only be concerned with earthly things”. But that was an aside.

Martin Luther claimed that we cannot reach salvation bay “doing good” but only by faith. But can we even choose to believe in God and in Jesus having absolved us from our sins? Oh, no. that, too, is determined by God:

Every time people are converted, it is because God has come to them and overcome their ignorance by showing the Gospel to them. Without this, they could never save themselves.

And:

Grace is freely given to the undeserving and unworthy, and is not gained by any of the efforts that even the best and most upright of men try to make.

Luther claims to have Scripture on his side: He notes that when people have done bad things, it is not because they have chosen to, but because God “has hardened their hearts”. So, if we do good, it is God who has made us do good, and if we do evil, it is God who has made us do evil.

- Faith versus reason? I will just quote Luther again:

Reason is the devil’s highest whore.[8]

$ $ $

Religion has been a dominating force in man’s life since time immemorial; and the Western world has undoubtedly been dominated by Christianity. So to say that Christianity is part and parcel of our Western civilization and heritage is just a platitude. But are the things I have listed above Western values? Are they even civilized?

Ayn Rand said that the saving grace of Christianity is that it preaches the sanctity of the individual soul:

There is a great, basic contradiction in the teachings of Jesus. Jesus was one of the first great teachers to proclaim the basic principle of individualism — the inviolate sanctity of man’s soul, and the salvation of one’s soul as one’s first concern and highest goal; this means — one’s ego and the integrity of one’s ego. But when it came to the next question, a code of ethics to observe for the salvation of one’s soul — (this means: what must one do in actual practice in order to save one’s soul?) — Jesus (or perhaps His interpreters) gave men a code of altruism, that is, a code which told them that in order to save one’s soul, one must love or help or live for others. This means, the subordination of one’s soul (or ego) to the wishes, desires or needs of others, which means the subordination of one’s soul to the souls of others.

This is a contradiction that cannot be resolved. This is why men have never succeeded in applying Christianity in practice, while they have preached it in theory for two thousand years. The reason of their failure was not men’s natural depravity or hypocrisy, which is the superficial (and vicious) explanation usually given. The reason is that a contradiction cannot be made to work. That is why the history of Christianity has been a continuous civil war — both literally (between sects and nations), and spiritually (within each man’s soul). (Letters of Ayn Rand, p. 287.)

You may object that Christianity has also accomplished some great things. A couple of great philosophers – philosophers acknowledged by Objectivists to be great – were Christians (Thomas Aquinas and, to some extent, John Locke).[9] And Isaac Newton, arguably the greatest scientist of all time, was a Christian.[10]

Speaking personally, I enjoy churches and cathedrals. And certainly some Christians have composed some great music. What famous classical composer has not composed a religious oratory or a mass? And the greatest of them all, Johann Sebastian Bach, has been called “the fifth evangelist”.

But this does not really change my point. For example, are cathedrals humble? Or are they intended to make us feel humble, when we enter them? And where is the humility in Bach’s music?

It all boils down to this question: Is our Western civilization what it is because of Christianity or despite Christianity? If you answer “because of”, beware of the implications!

[1] For Scandinavian speaking readers, this essay is also available in a Swedish translation.

[2] For a discussion of this, see Søren Kierkegaard’s Fear and Trembling (or Frygt og Bæven in the Danish original).

[3] She told this to a patient, and the patient answered: “Then I want him to stop”.

[4] There is a story about Frank O’Connor (Ayn Rand’s husband) that his parents sent him to a Catholic school; but when they tried to teach him that babies are born in sin, he left and went to a common, non-religious school instead.

[5] I exclude some composers, like Henryk Gôrecki, Arvo Pärt and all the minimalists. But you may listen to them, if you want to torture your eardrums.

[6] This idea was launched by Max Weber. But I guess you already knew that.

[7] De servo arbitrio in the original Latin. It was an answer to Erasmus of Rotterdam’s De libero arbitrio or On the Freedom of the Will. My quotes are from a section that has been published separately on the web.

[8] ”Vernunft ist des Teufels höchste Hure” in German. I call this rejection of reason “the fallacy of the stolen faculty“. Everyone has to use his reason even to put a simple sentence together, and Martin Luther did much more: apart from all the tracts he wrote, he translated to whole Bible into German and is credited with being the creator of modern German. How could he do this without “whoring with the devil”?

[9] Bad philosophers, according to Objectivism, include St. Augustine, Descartes and Immanuel Kant. Augustine and Kant certainly championed (if that is the right word) original sin and man’s innate depravity.

[10] He was an anti-Trinitarian, i.e. he opposed the doctrine of the Trinity. He is also reported to have said that space and time are the thoughts of God.

According to George Reisman’s theory, the level of profit in the economy as a whole is equal to the net consumption of the capitalists (I leave net investment aside, because I don’t think it changes my point). As long as the capitalists have a low time preference, net consumption stays at this low level; the greater part of their wealth goes to productive investments. And the richer they become, the lower becomes their time preference, the more gets invested, the more gets produced, the more workers get employed and the higher their wages become.

According to George Reisman’s theory, the level of profit in the economy as a whole is equal to the net consumption of the capitalists (I leave net investment aside, because I don’t think it changes my point). As long as the capitalists have a low time preference, net consumption stays at this low level; the greater part of their wealth goes to productive investments. And the richer they become, the lower becomes their time preference, the more gets invested, the more gets produced, the more workers get employed and the higher their wages become. The honor of having discovered the role of time preference goes to Eugen von Böhm-Bawerk. Later “Austrian” economists, such as Mises, have considered his explanation of the causes of time preference as not quite satisfactory. But the one who nails it is, once again, George Reisman:

The honor of having discovered the role of time preference goes to Eugen von Böhm-Bawerk. Later “Austrian” economists, such as Mises, have considered his explanation of the causes of time preference as not quite satisfactory. But the one who nails it is, once again, George Reisman: George Reisman’s Capitalism: A Treatise on Economics is perhaps the greatest treatise on economics of all time; it certainly ranks with such works as Adam Smith’s The Wealth of Nations or Ludwig von Mises’ Human Action; and in one respect I think it surpasses them: even the great pro-capitalist economists in the past have had contradictions and/or inconsistencies in their reasoning that undercut their message and make it weaker than it could and should be. If there are contradictions or inconsistencies in Reisman’s treatise, I have yet to find them.

George Reisman’s Capitalism: A Treatise on Economics is perhaps the greatest treatise on economics of all time; it certainly ranks with such works as Adam Smith’s The Wealth of Nations or Ludwig von Mises’ Human Action; and in one respect I think it surpasses them: even the great pro-capitalist economists in the past have had contradictions and/or inconsistencies in their reasoning that undercut their message and make it weaker than it could and should be. If there are contradictions or inconsistencies in Reisman’s treatise, I have yet to find them. In all probability, the least intelligent and most destructive method of fighting inflation is price and wage controls.

In all probability, the least intelligent and most destructive method of fighting inflation is price and wage controls.

You must be logged in to post a comment.